7 considerations to make you understand why I don’t agree with Tsipras

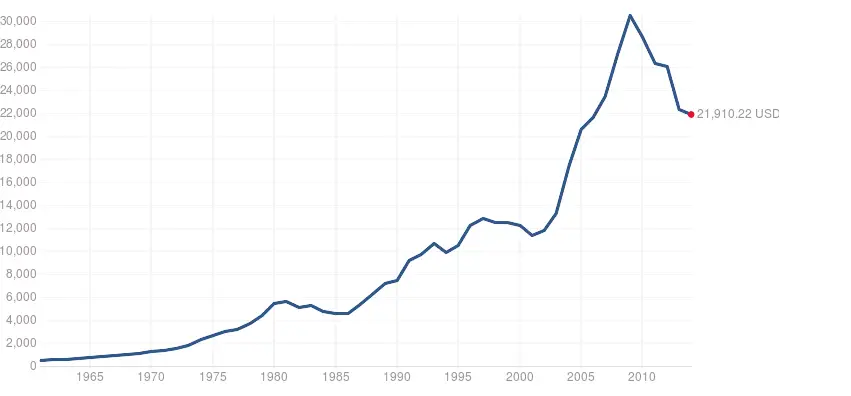

This is a graph of Greece GDP per capital. The spike corresponds to Greece joining the Euro. One doesn’t need to be an economist to recognize that Greek wellbeing until 2007 was an illusion, fueled by government spending and inflows of foreign credit. If one thinks in strictly economic terms and wants to restore the equilibrium by bringing Greece back to its economic fundamentals, its GDP still today is much higher than it would have been without European credit. From this perspective, there is little to argue: Greece has to deflate its gdp even further and return the wealth it has seized to its creditors: this is how debt-financed bubbles ends: tragically.

Then there is the argument: “austerity has not worked”. False: austerity has indeed worked in reducing the obscene government deficit. Greece government balance has shrunk from over 15% to just 2.5% in 2014. No matter what your political ideas are, a 15% deficit needed to be corrected at any cost: and you can’t run keynesian policies when you are starting from such a fiscal position: in order to counteract the cyclical fluctuations, you need first to have enough fiscal space. But if you are already running a deficit to fuel an artificial growth, austerity-induced economic depression is just the obvious, unavoidable reckoning. Blaming the creditor for this is idiotic: it means being unable to see the broad picture and the real responsabilities for an insane economic policy that needed to come to an end, eventually. The fact that this depression harms real people is terrible, we all agree. This is why a sound fiscal policy is so important. But once you have fucked it up, there is not much you can do (unless you default). You cannot just go back, you have to face the consequences of your actions. This is not a neoliberal dictate, this is just the bare, cold reality of numbers. A reality that has been caused by greek governments, not the EU, not the IMF.

Third: conditions of the agreement with the creditors. Greece has an avarage cost of debt of 2.5. It means that, on avarage, the greek government pays only 2.5% interests on its debt. To have a comparison, consider that Italy pays more than 4%. This already gives an idea: the conditions negotiated with the troika are already extremely favorable. In addition, Greece has already defaulted on part of its debt in 2012. The terms of the new agreement that was being negotiated in the last weeks, have been further eased. Everybody was well aware that even so, a repayment of the entire debt would require decades. But this was already a favourable compromise: creditors would take some losses, Greece would commit to fiscal discipline.

Fourth: sound fiscal policy. The central point of the agreement was in fact not debt repayment, but fiscal discipline. Nobody can deny that greek economic policy was a disaster. The troika wanted to make sure that this would not happen again. In exchange of financial help, these institutions required Greece to commit to sound economic policies. And there is nothing more unsound in Greek policies than the pension system. As it is now, greek pension system is completely unsustainable and in a couple of decades would become a huge black hole for public finances. This, again, is not a neoliberal theorem. It is a mathematical truth. If you want to maintain such a system, fine, but you need to find the resources to finance it. Otherwise Greece will face another fiscal crisis 20 years from now. This is where Tsipras broke the negotiations.

Fifth: debt relief. Why doesn’t the EU just forget about the Greek debt? It is not a moral issue: nobody wants to punish Greece, nobody wants to inflict any suffering to the Greek people. As an italian, I am somewhat concerned about the 35 billions of taxpayers’ money that Italy has lent to Greece, but this is not the main reason why the EU does not write greek debt off. The reason is: moral hazard, which in economic jargon means that we need to stick to the rules in order to prevent any country from conducting unsustainable policies again. If we write this debt off, Greece – and not only – would have the incentive to run fiscal deficits again, because it knows it would get away with it without having to repay the debt. But if Greece were credible, implemented the necessary reforms and conducted a cautious fiscal policy, trust would be soon restored and debt refief may be eventually viable.

Sixth: defaulting. Yet you can still default. Yes, you can, and considering the responsabilities of the creditors in lending to a country with unsustainable growth, a default would even be fair and would finally redistribute the costs of a collective failure. If you believe that the cost of the adjustment is higher that the cost of defaulting, it is not only legitimate but also rational to default. But this would mean exiting the Eurozone and all that this entails. It is a political decision: it’s up the the Greek people to take it. But one cannot remain in the Euro and blame the creditors for the mess.

Seventh: democracy. Giving the voice to the people is always the right thing, I read. It is not, I say. Call me a technocrat, an elitist. I prefer to consider myself a person aware of the limits of democracy. The best system of government is not the one that always pleases the people. It is the one that does the right thing for its people. The problem here is that the right thing does not concern only the Greek people, but also the citizens of other 27 european countries. A good government in such a situation would take the hard responsability of explaining what is right and what is wrong to its own constituency, taking into account all the parties involved. Unfortunately Tsipras is elected only by greek voters, and therefore is deaf to the reasons of any other country. Voters are not always the depositary of truth. Sometimes – often I would add – the majority is wrong. And a good democratic government does not indulge its electorate, it lead its people towards a higher good, however difficult it is.